Timber Recovery FAQs and Block Grant Program Presentation

Timber Recovery Block Grant Program Presentation

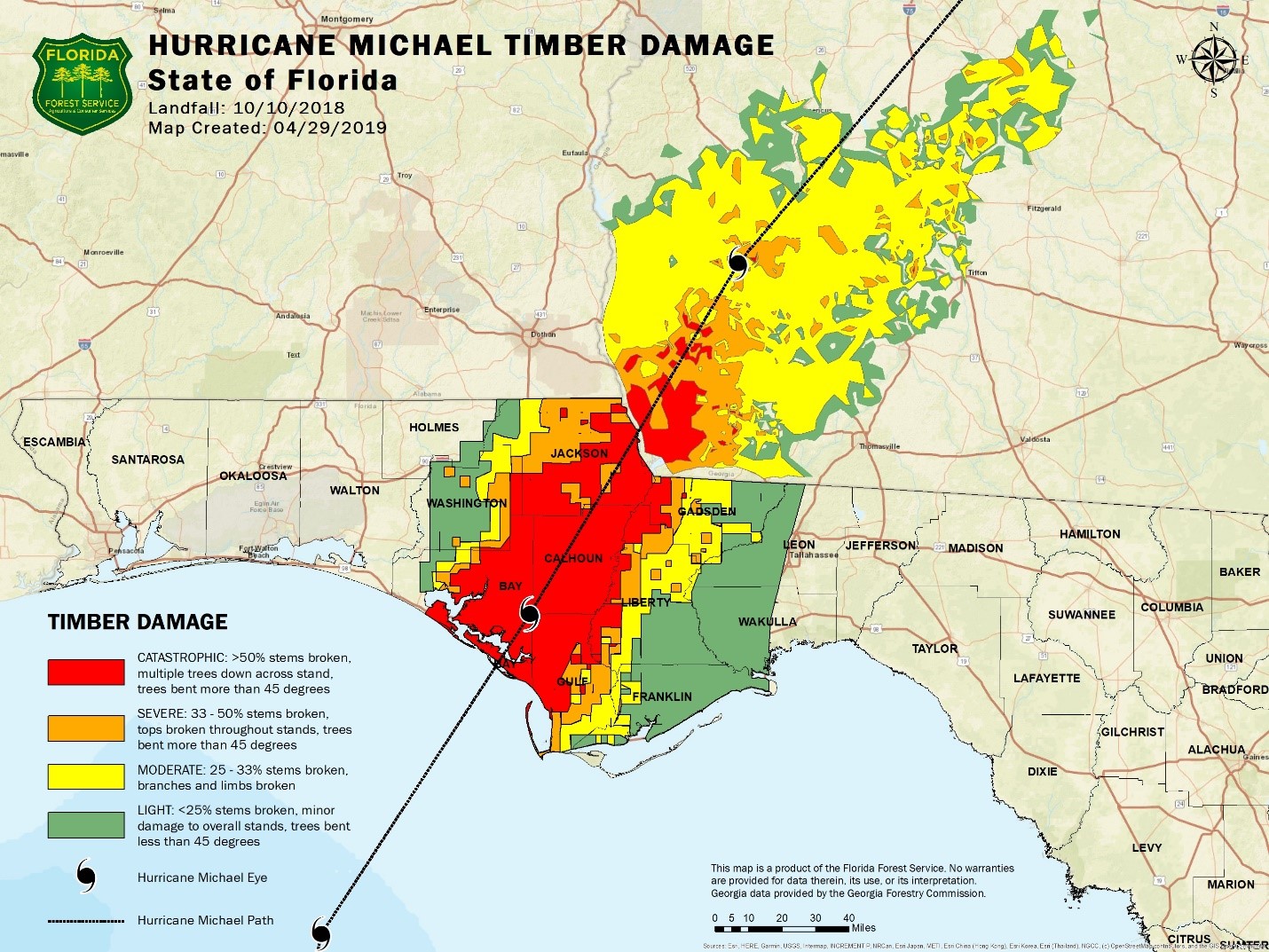

Damage Zone Prioritization

In order to manage the large volume of eligible producers and to ensure that producers with the highest level of damage receive payment first, applications will be processed based on where your timberland is located within the various damage zones identified by the Florida Forest Service. Producers with timberland located in areas designated as Catastrophic or Severe (identified in red and orange on the map) will receive priority over producers located in the moderate areas.

Producers with timberland located outside of the Catastrophic or Severe damage zones may still be eligible to receive payment under the block grant. Be sure to complete the online registration form prior to the registration deadline even if your timberland is located outside of the Catastrophic or Severe damage zones. Once you register, you will be notified that you have been added to the waiting list. No further action will be needed from you at that time. An Account Manager will be assigned to you once the application intake and review process has started and will reach out to you regarding next steps.

Please contact us at 850-270-8317 if you have any questions regarding your eligibility and your Account Manager will review your information with you.

Q: What is the block grant?

A: The block grant is a new grant program managed by the State of Florida and is separate from other federal programs related to timber reforestation. Rather than a loan or a reimbursement, the block grant provides direct payment to landowners to help recover lost income from the timber crop that was damaged or destroyed as a result of Hurricane Michael.

Q: How do I apply to the block grant?

A: Producers should first register for the block grant on our website: www.floridadisaster.org/timber. Once you have registered online, an Account Manager will contact you via phone within five business days and will assist you with the application process. Producers should wait until they are contacted by their Account Manager before completing an application.

Q: What is an Account Manager?

A: Account Managers are grant specialists that are trained to assist applicants with the application process for the timber block grant. Each applicant to the block grant is assigned an Account Manager who will be their direct point of contact throughout the block grant.

Q: What can my block grant payment be used to purchase?

A: Unlike some programs that are specifically related to reforestation or equipment replacement, the block grant is to help recover lost income from the timber crop that was destroyed as a result of Hurricane Michael. Once your application has been approved and you receive your payment from the State of Florida, that is your money to spend as you see fit.

Q: Is my block grant payment taxable income?

A: Yes, all block grant payments to applicants are taxable income and are subject to 1099 reporting with the IRS. As part of the application process, all applicants will be required to register in the State’s MyFloridaMarketPlace Vendor System and with the Department of Financial Services (DFS) to complete a Substitute Form W-9 for 1099 reporting purposes.

Q: Will applying to the block grant impact my eligibility for other grant programs?

A: Applying to the block grant should not impact your ability to apply to other grant programs. The block grant is a payment to landowners to help them recover a portion of their lost income from timber crop damage as a result of Hurricane Michael. If you are applying to another grant program for reforestation activities, such as the FSA Emergency Forest Restoration Program (EFRP), there would not be a duplication of benefits because EFRP pays for reforestation while the block grant pays for timber crop loss.

Q: I have submitted an application to the block grant but I do not know if I am eligible. What are my next steps?

A: Your account manager will assist you with the application and eligibility verification process. Typically a site inspection and/or review of available documentation will be required before a final determination can be made on the amount of funds you are eligible to receive through the program.

Q: If a producer owned property at the time of Hurricane Michael but sold it prior to applying for the block grant, are they still eligible to receive funds?

A: No, to be eligible to receive funds through the block grant, a producer must be the current owner of record or lessee with right to the timber crop for the property in an eligible county.

Q: What is an eligible county?

A: Eligible counties are those within Florida that received a Presidential Disaster Declaration as a result of Hurricane Michael. The following counties are eligible: Bay, Calhoun, Franklin, Gadsden, Gulf, Hamilton, Holmes, Jackson, Jefferson, Leon, Liberty, Madison, Okaloosa, Suwannee, Taylor, Wakulla, Walton, and Washington.

Q: Am I eligible to receive funds if I already cleared my land?

A: Yes, you may still be eligible to receive funds through the block grant even if you have cleared your land. Staff will utilize all available documentation to verify your eligibility for the program. Your Account Manager will be able to provide more information once you register.

Q: If I am participating or have participated in other state or federal programs, am I still eligible to participate in the block grant?

A: Yes, you may still be eligible to receive funds through the block grant even if you have received funds from other state and federal grant programs. Please notify your Account Manager of any other grant funds you have received for Hurricane Michael related losses on your property.

Q: Are non-citizens eligible to apply to the Block Grant?

A: To be eligible for the block grant, applicants must fall into one of the following categories:

- citizen of the United States;

- resident alien; for purposes of this part, resident alien means “lawful alien” as defined in 7 CFR part 1400;

- partnership consisting solely of citizens or resident aliens of the United States; or

- corporation, limited liability corporation, or other farm organizational structure organized under State law consisting solely of citizens or resident aliens of the United

Q: How do I get my block grant payment?

A: You need to register through the MyFloridaMarketPlace and MyFloridaCFO systems. There is a fact sheet available on the block grant website which provides directions for how to sign up. If you want a direct deposit you can set it up in MyFloridaCFO. If you want a hard copy check, do not complete your direct deposit information. We advise that you wait until your Account Manager contacts you as they can assist you with this process.

Q: How is my block grant payment calculated?

A: Payments are made based on a fixed dollar amount per acre that is assigned based on the age and species of the stand of timber, and whether the stand sustained a 25-34% loss or a 35% or greater loss. A detailed breakdown of the formula and the different payment amounts is available in the block grant

application and website. A forester from the block grant program will certify to the amount of loss that your timber sustained; you do not need to make the loss determination yourself.

Q: If I received funds through the block grant, do I have to reforest?

A: Yes, if you receive funds through the block grant on more than 20 acres, you are required to certify that you will reforest your land. There are multiple methods for reforestation allowed under the program. If you do not know which method is right for you, a forester can provide you with additional information.

- Apply for maximum eligible benefits under any of the governmental reforestation Example: Emergency Forest Restoration Program (EFRP) or similar program for reforestation.

- Show documentation from the State in support for natural hardwood or sand pine

- Be willing to cover all reforestation costs without state or federal

- Have adequate survival of the existing stand to maintain a healthy forest, as determined by the

Q. How long does it take to get my payment once everything is properly signed and submitted?

A: The time for receipt of payment varies. Once all required documentation is executed and approved, payment should be received in less than forty (40) days.

Q. How many payments can I expect?

A: Only one payment will be made to eligible producers under the block grant.

Q. How are payments made if I share ownership on my timber stand, do you split up the payments for each owner?

A: The current owner of record is required to be the applicant for eligibility determination procedures. Should the owner of record elect to delegate authority to another individual or entity, a power of attorney will need to be submitted prior to processing the subject application. Payment will be processed to the applicant as registered in the State payment systems. Your Account Manager can assist with any unique situations; please let them know at the time of application.

Contact Us

For questions not addressed in this FAQ, please call 850-270-8317